March 17th, 2010 by

March 17th, 2010 by  Joern Meissner

Joern Meissner

Customers have a habit of demanding lower prices, especially when they believe a product’s price represents a huge profit for the company. The case in point here is e-books, just one of many digital products facing the e-pricing dilemma.

In recent weeks, thanks to the soon-to-be-released Apple iPad, five of the six major publishers banded together to demand a change in price. Up until now, Amazon, the leading e-book seller, has set most bestsellers at a $9.99 price point, but by making a deal with Apple to price books from $12.99 to $14.99 and threatening to remove their products from Amazon’s online store and it’s e-reader Kindle, the publishers were able to push up the price.

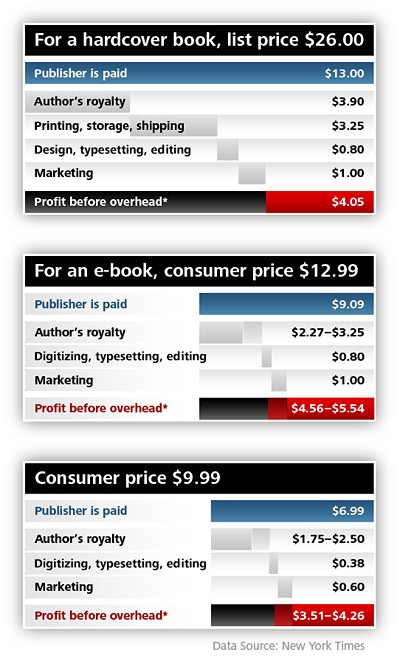

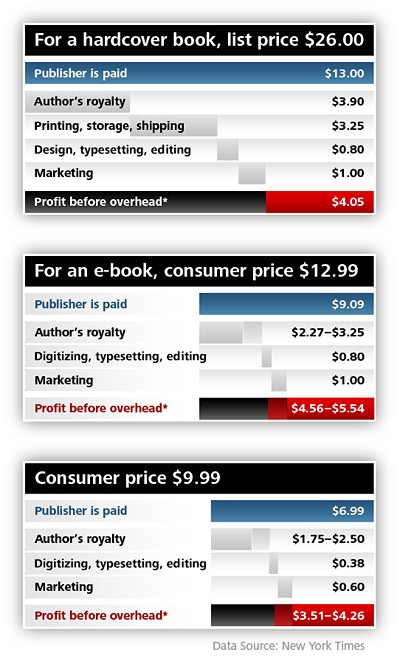

To illustrate why publishers keep pushing for the higher price, the recent New York Times article ‘Math of Publishing Meets the E-Book’ by Motoko Rich broke down standard hardcover book pricing and compared it to the new iPad digital pricing, also suggesting, according to Rich, that “customers have exaggerated the savings and have developed unrealistic expectations of how low the prices of e-books can go.”

A hardcover books costs about $26. After all the production, editing, marketing, and author’s royalties are paid (see graph), the publisher actually only sees about $4.05 in return, but that’s before any of the overhead bills are paid. Compare this to $12.99 digital price. In the new set-up with Apple, the publishers make between $4.56 to $5.54 in profit (see graph).

But this profit does not actually represent how much profit a publisher makes off any book. Like movie producers, publishers expect a loss on most of their products. Most books are published and disappear from the bookstore shelves long before the publisher recoups the author’s original advance and the original run’s printing costs. In the end, publishers truly only make money off major blockbuster books, further creeping into the publisher’s profitability.

On the other side of the pricing debate is the booksellers themselves. America only has two major booksellers left: Barnes N Noble and Borders, and many of the smaller independent have started shutting down due to Amazon. If the digital revolution takes hold with book-buying customers at too low a price point, it could also mean the end for traditional printed books, as there won’t be any bookstores left o sell them. Borders has already closed the majority of their stores in the U.K.

Some are advocating that the publishing world should step away from digital publishing and should discourage their customers from buying e-books by setting a high price for them. A similar idea has been put forth to save newspapers, which seems to be failing.

Many, however, realize that trying to hold back the digital revolution simply won’t work. Anne Rice, one of the most popular paranormal and horror writers in the world, said, “The only thing I know is a mistake is people trying to hold back e-books or Kindle and trying to head off the revolution by building a dam. It’s not going to work.” Publishers, a notoriously conservative business as a whole, are going to have to find a way to start looking towards the future, if they want to make their products viable and profitable once more.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Amazon, Apple, Apple iPad, Barnes and Noble, Books, Borders, Demand, E-Book Pricing, E-Book Publishing, E-Books, E-Publishing, E-Readers, Elasticity, iPad, iTunes, Kindle, Macmillan, Motoko Rich, New York Times, NYT, Paying for Content, Price, Pricing, Publishing, Sony, United States, USA

March 4th, 2010 by

March 4th, 2010 by  Joern Meissner

Joern Meissner

The story of the digital price wars is all about change. As each new technology develops and transitions into part of the mainstream culture, the way the average customer buys their goods is dramatically altered. And the price that customers pay must change right along with it.

According to the recent article ‘Is the price right for e-books?’ by BBC blogger Rory Cellan-Jones, the war over the price for e-book content is poised to become a major issue for the publishing world over the next year in the United Kingdom.

With Amazon, Sony, and Barnes N Noble all developing their own portable reading devices, UK patrons still complain that high prices and lousy access to the books they want have stopped them from purchasing e-books. This has allowed smaller companies like Kobobooks to develop e-readers that allow for easy reading across platforms (portable device, TV, computer, etc.) and easier, faster downloads.

However, it appears most customers care more about the price of the book then how they get it or where they can read it. With Amazon in a power struggle with publishers both in the UK and in America over who determines the price of books, the standard pricing for any book is far from being decided. In fact, just last month Macmillan, one of “Big Six” English language publishers, blocked Amazon from selling any of their products, in a move designated to keep digital book prices high. Macmillan and Amazon may have compromised, but this was surely just one skirmish in a long war.

Perhaps Amazon should focus on how Apple transformed the music world with iTunes. By designating a simple pricing scheme (99 cents per song), Apple was able to give customers the access, speed, and (most importantly) price they wanted. They also won many court cases that gave them the right to determine their own prices. If Amazon and the other e-readers can follow suit, a bottom line price could help drive e-books and e-readers into the hands of every UK citizen.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Amazon, Apple, Barnes and Noble, Books, E-Books, E-Publishing, E-Readers, iTunes, Kindle, Macmillan, Paying for Content, Price, Publishing, Rory Cellan-Jones, Sony, UK, United Kingdom

February 24th, 2010 by

February 24th, 2010 by  Joern Meissner

Joern Meissner

While it’s common knowledge that the music industry was forever altered when iTunes, with its over 125 million customers, came onto the scene and allowed music fans to download songs for only 99 cents. In the past few years, it was the publishing world that has been changed, with digital book eaders like the Kindle and Nook, and online newspaper programs, like the recently mentioned Times Reader. Now it appears, it’s TV’s turn.

According to the article ‘Networks Wary of Apple’s Push to Cut Show Prices’ by Brian Stelter (New York Times, February 16th, 2010), Apple executives are in talks with the heads of all the major television networks to plan a widespread price decrease for downloading TV episodes from iTunes.

Each TV show episode, with the exception of a few promotions from PBS, currently sells for a $1.99 per download. But for Apple, the magic number has always been 99 cents. It was the 99-cent price point that allowed iTunes to nearly overnight become the world’s main, and in most peoples’ eyes the only, place to buy music. iTunes’s 99 cent price point could very easily be said to be responsible for the end of the CD and probably helped lead to the end of nationwide electronic store Circuit City.

Apple executives are said to believe that by lowering TV episodes, released on iTunes only the day after their original broadcast on television, to the 99 cent price point could allow the mainstreaming of TV episode downloading, just as it did for music. With several new, cheaper models of digital and portal TV quickly becoming available, like Apple’s upcoming iPad, Apple believes this is its next goldmine waiting to be harvested.

TV executives on the other hand are not so sure. TV shows can cost millions of dollars to produce, and it normally takes hundreds of people (all of whom need to be paid) to produce a single episode. Unlike songs, which are often created in studios by a handful of professionals, TV shows will need far higher sales to return profitable returns.

On the other hand, if lowering the price point does help buying TV episodes become part of the mainstream world culture, as buying songs from iTunes has, then it might be worth it. Consumers have purchased over 10 billion songs from iTunes, while they have only purchased 375 million TV episodes, a huge difference in profits. And considering that there will also always be fewer episodes available then songs, this difference could translate into the change being well worth the risk for TV executives.

As with most digital products, there is little additional cost, so this situation is not about profit maximization, but simply revenue optimization. The refusal of the TV executives to lower the price indicates that they believe the market is not elastic, e.g. they do not believe there would be a volume gain sufficient enough to compensate for the lower price. In this particular case the calculation is easy, as a price decrease from $1.99 to $0.99 must result in doubling the volume to make sense. Apple, on the other hand, would probably be satisfied if it breaks even, as long as this fuels hardware sales.

A $0.99 price point could lead to a large demand raise, probably even of 100 percent. On the other hand, it could be that TV content is already bought by users that are less likely to download files from a peer-to-peer file sharing network, and demand is not actually elastic, which would be required if the demand was to raise high enough. In any case, it will be interesting to see what is going to happen.

![[Slashdot]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/slashdot.png)

![[Digg]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/digg.png)

![[Reddit]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/reddit.png)

![[del.icio.us]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/delicious.png)

![[Facebook]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/facebook.png)

![[Technorati]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/technorati.png)

![[Google]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/google.png)

![[StumbleUpon]](http://www.meiss.com/blog/wp-content/plugins/slashdigglicious/icons/stumbleupon.png)

Posted in Pricing

Tags: Amazon Kindle, Apple, Apple iPad, Apple iTunes, Brian Stelter, Circuit City, Demand, Digital Pricing, E-Commerce, E-Products, Elasticity, iPad, iTunes, Kindle, Music, Nook, Paying for Content, Price Point, Pricing, Revenue Optimization, Television, Times Reader, TV Episodes, TV Series

![]() March 17th, 2010 by

March 17th, 2010 by  Joern Meissner

Joern Meissner